A June 6 press release by NWMLS put the Western Washington housing market into better perspective:

“Home sellers really need to re-think their expectations,” suggested Mike Larson, a member of the board of directors at Northwest Multiple Listing Service (NWMLS) when commenting on statistics summarizing May activity. The new report showed a significant increase in active listings compared to a year ago, a slowdown in sales, and prices still rising.

Larson, the managing broker at Compass in Tacoma, said the days of “multiple offers and waived inspections, at least in Pierce County, are behind us.” He described the market as “more balanced and not so crazy, and that’s a good thing. Buyers are getting a little relief – not much, but a little as we’re slowly easing back into the kind of market we had pre-COVID.”

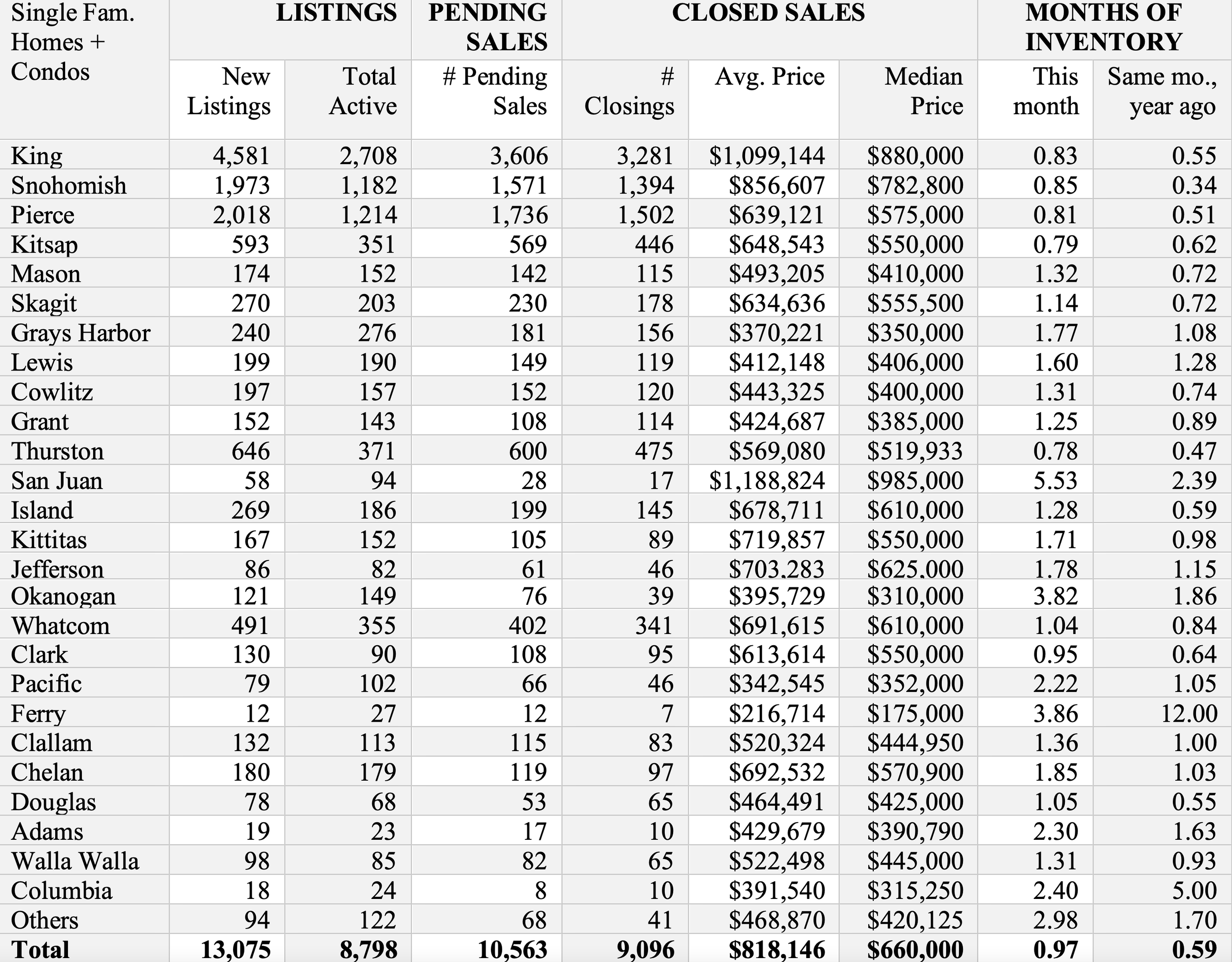

NWMLS members added 13,075 new listings to inventory during May, up 9.7% from a year earlier and the highest monthly number since June 2021.

At the end of May, buyers could choose from 8,798 active listings system-wide, up a whopping 59% from a year ago when there were only 5,533 properties in the database. That is the largest selection since September 2020 when there were 9,099 single family homes and condominiums offered for sale across the 26 counties served by Northwest MLS.

Two counties more than doubled their number of active listings from a year ago. The selection in Snohomish County jumped from 500 to 1,182 listings (up 136.4%). Douglas County had a similar increase, rising 134.5%. Also nearly doubling their inventory from a year ago were Cowlitz, Island, and Walla Walla counties.

“The significant increase in the number of homes for sale has some speculating that the market is about to implode, but that is very unlikely,” stated Matthew Gardner, chief economist at Windermere Real Estate. “What’s more likely to occur is that the additional supply will lead us toward a more balanced market, which after years of such lopsided conditions, is much needed,” he added.

Even with the healthy uptick in inventory, there is still less than one month of supply area-wide (0.97 months). Twenty of the 26 counties in the report are showing more than a month of supply, with the tightest inventory (0.85 months or less) in the four-county Puget Sound region.

Both pending sales (mutually accepted offers) and closed sales during May were down from a year ago, but up from the previous month.

Pending sales declined about 11.7% from twelve months ago but increased 8.2% compared with April. Members reported 10,563 pending sales of homes and condos last month, up from April’s figure of 9,760, but down from the year-ago total of 11,969.

Gardner believes the April-to-May increase indicates rising mortgage rates are not yet negatively impacting the housing market. “The additional supply of homes for sale is giving buyers more choices, which is something they haven’t had in several years,” he remarked.

Closed sales dipped slightly from a year ago (down about 3%) but rose 9% from April. Members completed 9,096 sales last month, which was 278 fewer than a year ago. May’s total outgained April by 752 transactions.

Buyers can expect to pay more for homes and condos, although the increases may be moderating. Last month’s system-wide median price of $660,000 was up 12.8% from the year-ago figure of $585,000. Comparing percentages, that was the smallest YOY increase since December 2020 when it was 12.2%.

“In May, we saw a slowdown in the steep price increases we have witnessed so far this year,” observed John Deely, executive vice president of operations at Coldwell Banker Bain. He noted prices for single family home sales (excluding condos) in King County jumped from $775,000 in January to a whopping $995,000 in April, a change of $220,000 in only four months (a jump of 28.4%). Prices for single family homes in King County were nearly unchanged from April ($995,000) to May ($998,888).

“Rising interest rates coupled with inflation are causing buyers that rely on conventional mortgages to reconsider the affordability, and possibly take a break or look in areas that are less costly,” Deely commented. “We seem to be heading from an extreme seller’s market toward a more balanced market with increasing inventory.”

J. Lennox Scott also commented on market adjustments. “Unsold inventory is ticking upward locally as more new listings hit the market. This gives buyers an increased selection of desirable properties to choose from as they hunt for their new home,” said Scott, the chairman and CEO of John L. Scott Real Estate.

“Though there is still a steady backlog of buyers in the market, the increase in inventory means each home will receive fewer offers and may not go pending the first weekend,” Scott remarked, adding, “Seasonal home price flattening is also in play, which means premium pricing is off for most properties.”

NWMLS figures show last month’s sales fetched 105.7% of the asking price, down from April when it was 107.7% and March when it was 108.2%.

Scott also noted luxury sales activity has held steady due to strong buyer demand in the Puget Sound area. He attributes this to “a backlog of buyers along with factors like job growth and our thriving local economy.”

MLS figures show there were 95 sales of properties priced at $2 million or more in January. That number rose to 136 in February, 325 in March, 389 in April and 353 in May.

Frank Wilson, Kitsap regional manager at John L. Scott Real Estate, is detecting “light breezes of change” in that county. “Homes are staying on the market a few days longer. We are still receiving multiple offers, but not as many.” He also noted inventory is slowly growing. MLS figures show supply in Kitsap County is up nearly 39% from a year ago.

“Finally, some balance in the market for homebuyers,” exclaimed Dean Rebhuhn, owner at Village Homes and Properties in Woodinville. “Last month provided more buying opportunities due to increasing number of new listings and more flexible sellers willing to work with buyers on finance and inspection contingencies,” he remarked, but also reported, “Price reductions are on the increase from sellers as overpriced properties are languishing on the market.”

“Things have changed,” agreed Dick Beeson, managing broker at RE/MAX Northwest Realtors in Gig Harbor. “Sellers who expect to get more than their asking price are unhappy if they receive offers only slightly above their list price. Sellers are now more often required to consider offers contingent upon financing, inspections, or the sale of the buyer’s home. Things that were normal in purchase contracts just two years ago are making their return,” he stated.

Beeson expects inventory will continue to grow as more sellers realize now is the time to sell. “Otherwise, their home’s appreciation simply becomes unrealized phantom equity, especially if prices fail to continue their dizzying upward spiral.” And, he suggested, “That day is drawing near.”

Despite some conditions tilting to favor buyers, Beeson said some buyers have given up hope, choosing to sit on the sidelines waiting for a more “normal” or falling market. “Those days are a mirage.”

Reflecting on his 40 years in the business, Beeson wondered, “Who would ever imagine increases of nearly 65% in inventory in Pierce County and nearly 36% in Pierce and King County would only produce less than a month’s supply of homes for sale? Imagine prices escalating at 15% or more a year, yet the number of closed sales is falling. Imagine buyers looking at the increased inventory, increased prices and still experiencing serious competition with a plethora of other buyers for most homes. That’s the world of today in Western Washington!”

Would-be owners of condominiums will find limited choices with inventory down more than 9% from a year ago. Prices are up nearly 15%, rising from $435,000 to $500,000.

“The only constant is change,” said Gary O’Leyar, another broker with decades of experience. “Although we have been through a long run-up in the market, history tells us that the real estate market never remains static. There is a definite shift in buyers’ patterns,” according to O’Leyar, the designated broker/owner at Berkshire Hathaway HomeServices Signature Properties in Seattle.

O’Leyar also noted there are many “micro markets” within each county. Within King County, for example, Northwest MLS tracks data for 30 map areas. Last month’s median sales prices ranged from $565,400 in the area encompassing Dash Point and Federal Way to nearly $2.6 million on Mercer Island. Also notable is area 720 where Shoreline and Lake Forest Park are located. That area had a year-over- year price bump of 52.4%, with the median price surpassing $1 million for the first time, according to MLS records. In nine of the 30 map areas in King County, median prices exceeded $1 million last month.

O’Leyar acknowledged “outside influences beyond our local control” are factors contributing to market changes. He cited interest rates and the price of gasoline among them.

There are local dynamics that also impact activity, O’Leyar emphasized. “Employment is a significant barometer,” he suggested. “King County enjoys an extremely low unemployment rate, recently at about 2% which is notably below the state and national rates around 4.1% and 3.6%, respectively. When clients ask for market forecast opinions, my consistent ‘go to’ reply has been “Watch the employment numbers along with population numbers of people entering or exiting the market. It’s basic supply and demand.”

Northwest Multiple Listing Service is a not-for-profit, member-owned organization that facilitates cooperation among its member real estate firms. With more than 2,500 member firm offices and 32,000 brokers across Washington state, NWMLS (www.nwmls.com) is the largest full-service MLS in the Northwest. Based in Kirkland, Washington, its service area spans 26 counties, and it operates 21 local service centers.

NWMLS news release: May activity